EU holds back Italy’s anti-euro tide for now

Brussels-Rome war:

EU holds back Italy’s anti-euro tide for now

Steve Keen is an Australian economist and author. He’s professor and Head of the School of Economics, History and Politics at Kingston University in London. You can support his attempts to build a new economics https://www.patreon.com/ProfSteveKeen.

By pushing a presidential veto of Rome’s proposed new government, Brussels may have secured the euro’s status in Italy, for now. However, it may prove to be only a stay of execution.

As I write, a constitutional crisis has erupted in Italy after its President – who normally fulfils only a ceremonial role – refused to allow the prospective new coalition government to appoint Paolo Savona as finance minister.

Superficially, this is a ridiculous decision: Savona is a distinguished 81-year-old economist who has worked at Italy’s Central Bank and Treasury, created the first model of the Italian economy, and – among numerous other honors – was a minister in a previous Italian government in 1993-94. Was his age the problem?

No, President Sergio Mattarella’s problem with Savona is that he is a critic of the euro. And Mattarella’s obstructionism is a problem for the prospective coalition government of the self-described anti-establishment Five Star Movement (founded by the satirist and activist Beppe Grillo) and the originally secessionist, but now federalist, Lega Nord (Northern League) – because about the only thing they have in common is opposition to the euro and the austerity policies that have come with it following the 2008 crisis.

In round one of what will be a protracted battle, the prospective prime minister Giuseppe Conte has resigned; the leader of Five Star has called for the president to be impeached; and the president has invited former International Monetary Fund director, Carlo Cottarelli, to form a government instead.

This conflict won’t end by making Cottarelli interim prime minister. He gained the nickname of “Mr Scissors” when he was put in charge of reviewing government spending by a previous, short-lived government in 2013. He is a vocal critic of the Five Star/Northern League proposals, but these parties hold a majority of seats in the parliament. They will almost surely vote him out of office.

The likely short-term outcome is the calling of fresh elections – three months after the vote which made Five Star the largest political party in Italy.

Opening Salvo

The first battle in the war between Brussels and Rome has thus been won by Brussels: I have little doubt that Mattarella was lobbied very strongly by EU figures to block Savona, because he is capable of developing the real weapon that Five Star/Northern League could bring to bear against the euro – the “mini-BOT.” Named in reference to Italy’s “buoni ordinario del tesoro,” which are short-term government bonds, these would be government-issued notes valued at between €1 and €500, which would be issued to people and companies owed tax refunds by the government. These, in turn, would be valid for paying taxes, buying train tickets, getting petrol at government-owned fuel stations, and so on.

These sidestep the euro’s monopoly as legal tender in the eurozone because a vendor does not have to accept these if they are tendered in an exchange. But they can be accepted, perhaps at a discount to face value, and thereby become an alternative means of payment to the euro.

This is a weapon that Greece prepared, but never used, because Yanis Varoufakis, in what he describes in Adults in the Room as “Mea Maxima Culpa” (“my most grievous fault”) decided to leave the decision to Alexis Tsipras. Tsipras demurred, and the result was a Greek tragedy.

An alternative-means-of-payment is a much more cogent weapon in Italy’s hands than it would have been in Greece’s. Italy’s economy is six times larger than Greece’s and average salaries are almost double (though per-capita income has fallen substantially since the global financial crisis); its economy, particularly in the north, is an industrial powerhouse; and its climate supports a huge range of agricultural products. Much more of what Italians need to buy can be purchased from other Italians than was ever feasible for Greece (the only categorical exception is oil). The mini-BOT could really free Italy from the stranglehold of the euro.

Poor Design

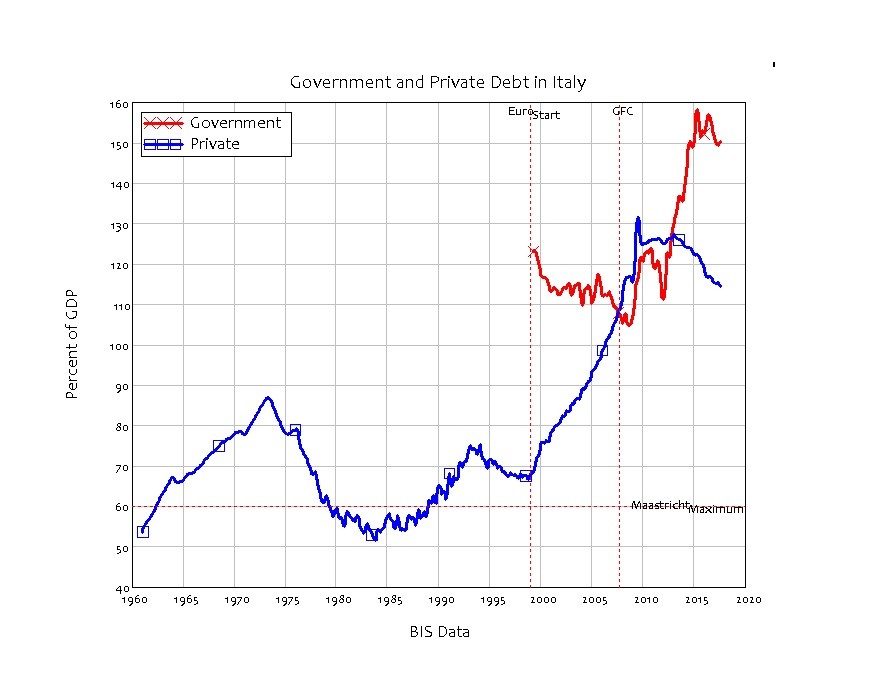

And a stranglehold it is. The Maastricht Treaty’s pact to limit government debt to 60 percent of GDP and government deficits to three percent appeared as “sound finance” to its drafters, but was really a decision to hand over money creation to private banks.

The Maastricht limits on government spending and debt were also farcical: Italy’s government debt when the euro came into being was more than twice the Maastricht limit. The fact that Italy was allowed in under these rules shows that the euro project was driven far more by politics and naive economics than it was by financial imperatives.

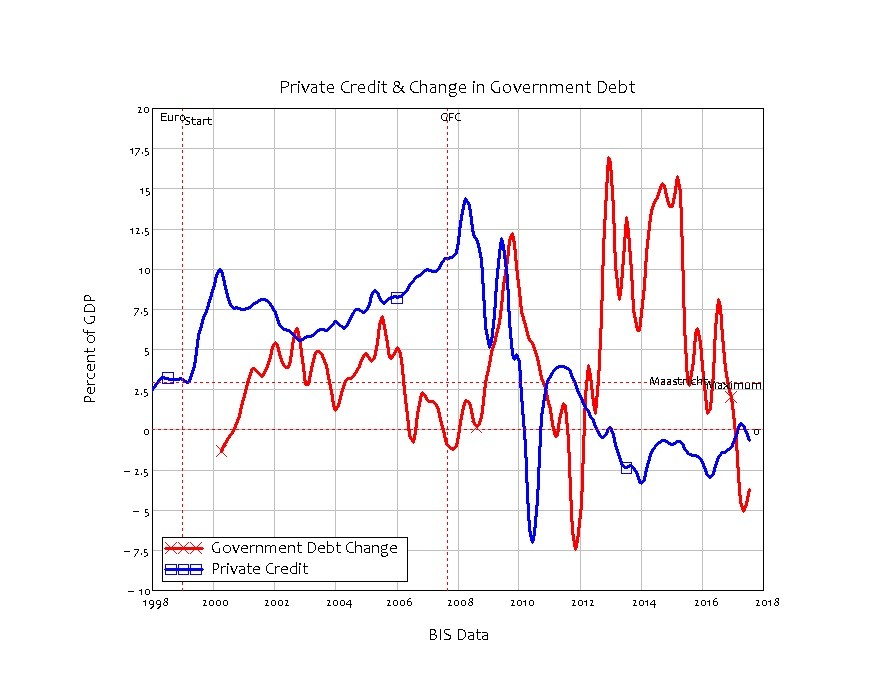

The vague hope was that Italy would use growth and the discipline of the euro to reduce its government-debt ratio. But progress stagnated and private debt rose because, under the Maastricht Treaty, Italians had only one source for new money: borrowing from the private banks. Before the euro, an Italian government deficit (if backed by Central Bank bond purchases) injected lira into the economy; after it, that injection was limited to no more than three percent of GDP.

The impact was immediate: with the fiscal space, Italian firms and households turned to the banks. Private debt, which had been low and trending downward before the euro, exploded when its shackles were in place.

The additional credit-based demand this generated enabled the government to reduce its debt level somewhat, but only until the global financial crisis (GFC) brought Europe’s private debt binge to a shuddering halt. As credit dried up, government spending exploded, hitting four times the Maastricht limit in 2010 before severe austerity measures were imposed.

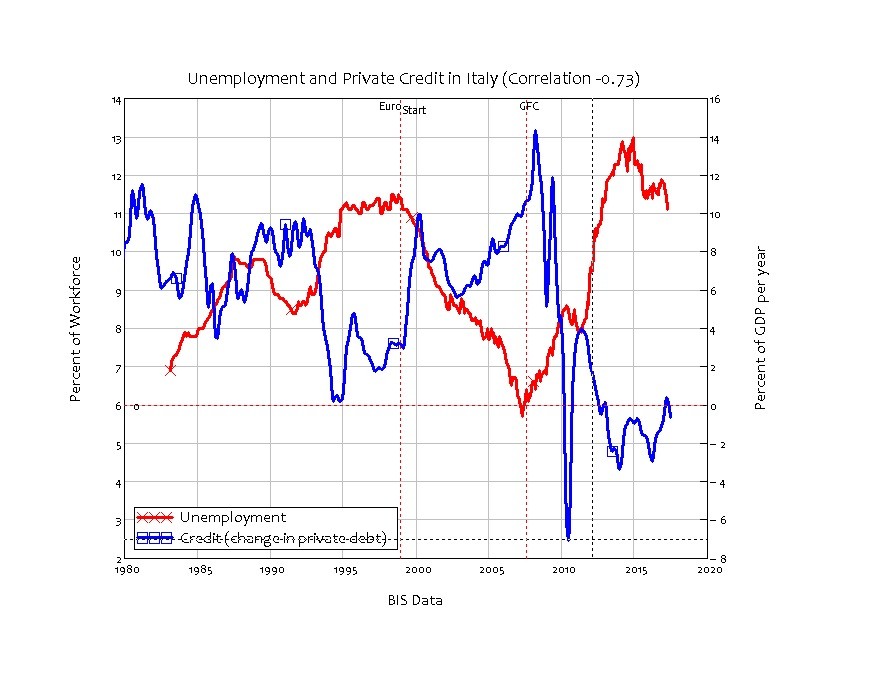

This budget blowout had to happen, because the collapse in credit drove unemployment skywards. Though unemployment had fallen from 11 percent when the euro began to six percent when the GFC struck, it skyrocketed to over 13 percent of the workforce when credit crashed from 14 percent of GDP in 2008 to minus 7 percent in 2010.

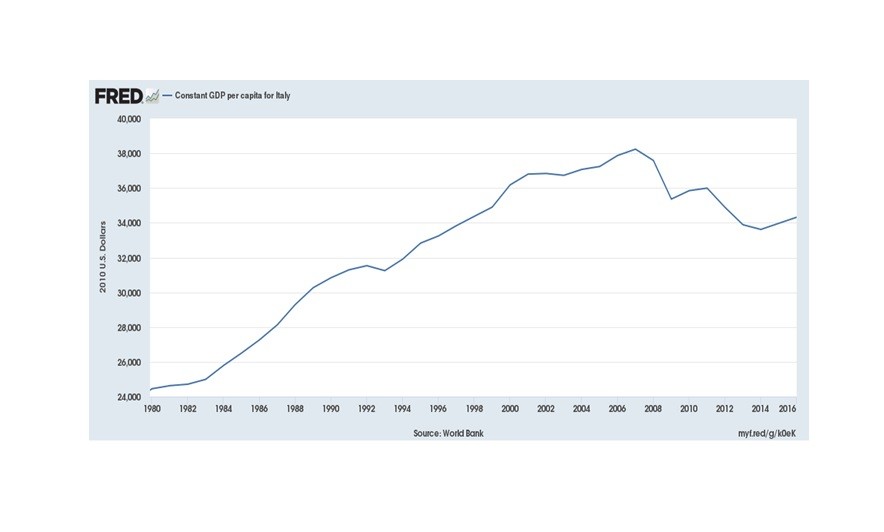

Austerity was then imposed by technocratic governments following Maastricht-style spending rules, and incomes and employment fell further behind. Per-capita GDP has fallen by over 10 percent since the GFC, and is now lower than before the euro was adopted in 1999.

Losing Game

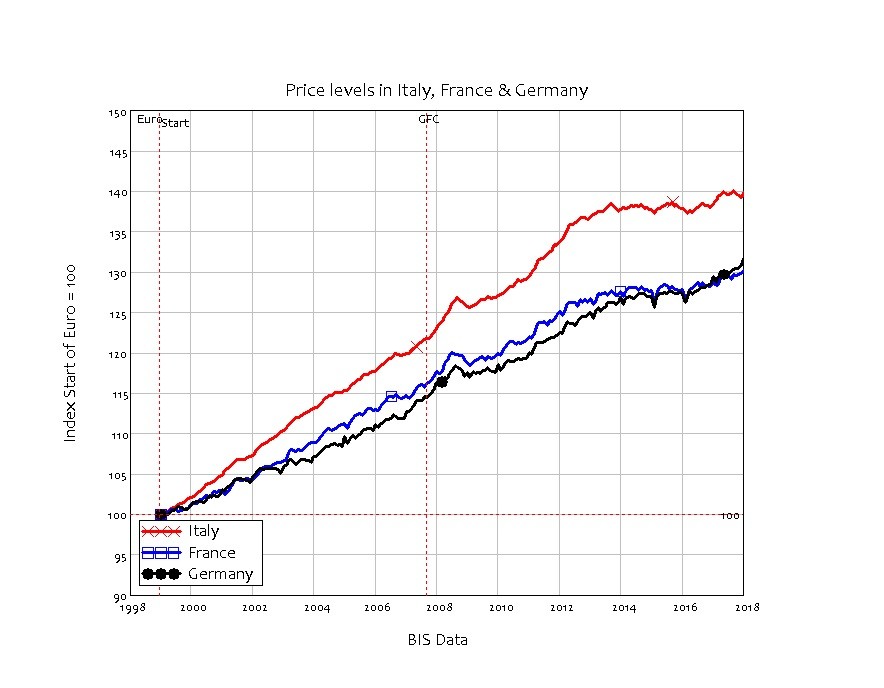

Italy’s other euro-related problem is inflation-driven by a lack of competitiveness with Germany. Since the euro began, the average inflation rate in Italy has been 1.8 percent. That is very low by historical standards, but it’s still above the 1.35-percent rate in France and the 1.4-percent rate in Germany. Though the differences are tiny, over the two decades since the euro began, Italy has become 10 percent less competitive with Germany. That’s a handicap that could easily be corrected by a 10-percent devaluation of the lira against the deutschmark. Unfortunately, such an option doesn’t exist today.

By the time this war between Brussels and Rome is over, that might change. Brussels has won the first round, with the boxing equivalent of not merely a below-the-belt punch, but of the referee knocking out the winner and declaring his opponent the victor. The next round will go to Brussels as well, as Mattarella appoints Cottarelli as prime minister. Round three will go to the Five Star/League as they vote to impeach Mattarella. Round four will be the campaign for the subsequent election, which will further polarize Italian politics: Brussels and its local allies will attempt to undermine or divide Five Star and the League with scandals and official opprobrium, while the Five Star/League will try to harness outrage at the undemocratic forces controlling Italy to increase their vote.

Brussels will seek to blame the anti-euro rebels, but the real villains of this crisis are the euro itself and the Maastricht Treaty. As the rebel British economist Wynne Godley stated back in 1992 when the Treaty was signed:

“If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalization, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation.” (Wynne Godley, ‘Maastricht and All That’ London Review of Books, October 1992)

Emigration, poverty, or starvation? There is a fourth alternative: leaving the euro. Brussels has blocked this for today, but the odds of it happening in the near future have risen dramatically thanks to Mattarella’s veto of Savona.

Comments

Post a Comment